Accept Foreign Currency Payments Abroad

With myPOS, you can easily accept card payments anywhere in Europe, in euros or another European currency. The myPOS payment terminals are perfect for entrepreneurs operating internationally.

Request a quote

myPOS Go 2

Our most affordable yet fully functional standalone payment machine

myPOS Go Combo

Our standalone card reader with a portable charging and printing dock

myPOS Ultra

Ultra powerful Android payment terminal with high-speed printer

myPOS Sigma

Card machines for vending, parking and ticketing hotspots

Website builder

Create your free online shop with myPOS Online and start selling everywhere

Online checkout

Increase your sales by integrating a secure, conversion-oriented payment gateway

Payment Request

You can now accept remote card payments without the need of a card machine

Payment Тag

Choose the myPOS Payment Tag for payments acceptance without a website

Virtual terminal

Turn your computer, mobile phone or tablet into an online credit card machine

Business debit cards

Order myPOS Business Cards, your first one is for free

Revenue-based financing

Get additional financing for your business from a myPOS trusted partner.

Accept payments abroad

Accept local currency with the myPOS payment terminals and multi-currency account.

Invoicing

Invoice customers and let them pay by card or by bank transfer

myPOS AppMarket

Choose from hundreds of third-party applications developed for myPOS Android card machines

Locations

Visit myPOS terminals reseller centers

Help Centre

All your questions answered

Contact us

Get in touch with myPOS

Our story

Learn more about us and our technologies

Leadership

Meet the leadership team

Careers

Looking for a fresh start?

Newsroom

All relevant content for press and media representatives in one place

With myPOS, you can easily accept card payments anywhere in Europe, in euros or another European currency. The myPOS payment terminals are perfect for entrepreneurs operating internationally.

Request a quote

To accept payments via a payment terminal, online payment, or webshop, you'll need a myPOS account.

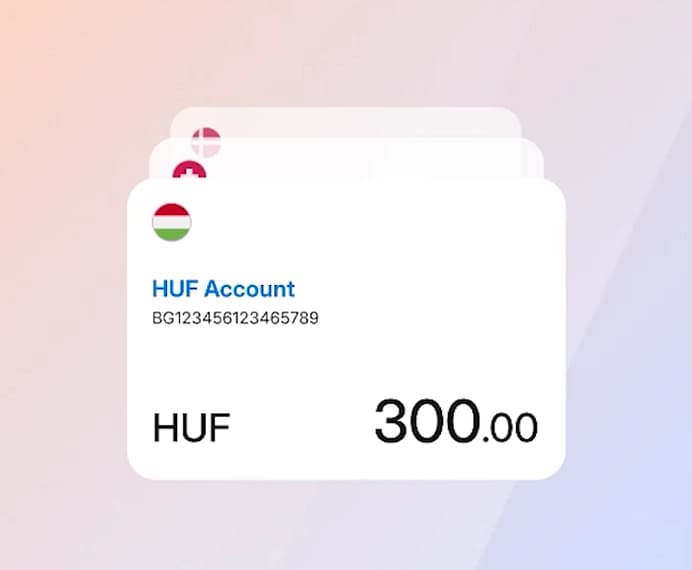

With this account, you can hold not only euros but also other currencies, such as Danish krone, Swiss francs, and Norwegian kroner. The myPOS account accepts payments in foreign currencies, and you decide whether you receive it in euros or a foreign currency. The multi-currency feature is completely free, no additional costs. Transferring between currencies is also free. The exchange rates are updated daily.

Within your myPOS account, you can set a specific currency for each payment terminal. Create sub-accounts for different currencies and link a payment terminal to the corresponding account. This avoids exchange rate fees. Additionally, you can link the myPOS business card to any of your foreign currency sub-accounts, allowing you to make payments in that currency with the card.

You can choose from the following foreign currencies:

Swiss Franc (CHF), Danish Krone (DKK), Norwegian Krone (NOK), Swedish Krona (SEK), Polish Zloty (PLN), Czech Koruna (CZK), Hungarian Forint (HUF), Romanian Leu (RON), Icelandic Krona (ISK)

Whether you are a taxi driver driving customers to Belgium, selling flowers in Sweden, or traveling through Europe as an artist – with myPOS you are always in good hands. All payment terminals are equipped with the DCC function and are suitable for accepting foreign currency payments abroad, without extra costs.

With Dynamic Currency Conversion (DCC), foreign customers can pay in their own currency. You receive the amount in the currency you've set in your account, such as euros. Customers immediately see the amount in their own currency, like yen for Japanese customers or dollars for Americans, with no surprises on their statements. The exchange rate is fixed, and DCC is free and automatically enabled.

When a customer pays with a currency other than euros, the myPOS terminal automatically displays the DCC menu with the exchange rate. The customer has the option between two amounts: the amount in euros or the amount in their own currency. Once the customer has made their choice, the payment proceeds as usual.

You will encounter an exchange rate when the currency of the accepted payment differs from that of your (sub)account. This applies to accepted payment cards, incoming or outgoing transfers, and payments with your myPOS debit card. The buying and selling rates can be found online, as well as in your myPOS account. These rates are updated every business day around 9:00 AM.

All myPOS payment terminals contain a free multi-provider data SIM card with unlimited data bundle for European coverage. This allows you to use the payment terminal throughout Europe without additional costs. The payment terminals operate completely independently, without needing cables or Wi-Fi.

The SIM card automatically switches between networks, such as KPN, Vodafone, and Odido in the Netherlands, and the strongest local network abroad. Whether you're at a trade fair in Belgium, an event in Germany, or a market in Sweden – you can accept payments everywhere effortlessly.

For entrepreneurs outside the eurozone, myPOS offers a simple solution to accept payments in local currencies without the hassle of bank accounts or extra fees. Whether it’s Swedish, Danish, or Norwegian kroner, Swiss francs, or Polish zloty, myPOS enables seamless business transactions anywhere. Customers pay in their own currency, and you receive the amount directly in your myPOS account.

Rates vary by country of operation. Fixed rates for debit Mastercard and Visa debit are only available to Dutch entrepreneurs whose businesses are registered in the Netherlands.

Note: The rate for your business depends on the country your company is officially registered.

1.75% + € 0,05

Per transaction

Mastercard

Consumer and business cards

from the rest of the world

2.85% + € 0,05

Per transaction

1.75% + € 0,05

Per transaction

Visa

Consumer and business cards

from the rest of the world

2.85% + € 0,05

Per transaction

American Express

2.45% + € 0,05

Per transaction

JCB

2.85% + € 0,05

Per transaction

Apple Pay, Google Pay

Varies.

depending on the debit or credit card linked to your e-wallet

Valid in: Andorra, Bulgaria, Cyprus, Denmark, Germany, Estonia, Finland, France, Greece, Hungary, Ireland, Iceland, Italy, Croatia, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Norway, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Spain, Czech Republic, and Sweden. In Belgium the Bancontact rate applies, see prices here

As a myPOS customer, you receive a free debit Mastercard that you can link to your myPOS account. With this debit card, you can pay worldwide in stores, online, and also withdraw cash from an ATM. Whether you're in Germany making purchases, paying an invoice, or refueling, it can all be done with the myPOS debit card.

All accepted payments are credited to your myPOS account within 3 seconds, even abroad, on weekends and public holidays. This way you always maintain a positive cash flow with real-time insights. Ideal if you need to do shopping, want to invest or need to pay invoices.

Feel free to contact us at [email protected] or call us at +31 13 7820990.

We are happy to discuss the possibilities with you.

Select your cookie preference

We use two types of cookies - Necessary and Personalisation cookies. Necessary cookies are stored and processed in order to ensure you can access our website and view all its content in a bug-free and seamless manner, while Personalization cookies help us to provide you with more relevant content. If you continue using this website without clicking on the accept button below, we will not store or process any Personalization cookies for you. You can manage the way you interact with our cookies anytime by clicking on the cookie settings in the footer or the “Customize Cookies” button below.

You will find more information, including a list of each type of cookie, its purpose and storage duration, in our Cookies Policy.

Necessary Cookies

We use these cookies to ensure the proper operation of our website. We would not be able to provide you with access to our services without these cookies and therefore you cannot refuse them. You can use your browser’s settings in order to remove them.

Personalisation cookies

We use these cookies to make our offers and ads more relevant to your interests and to improve our website’s user experience. More information about these cookies can be found in our Cookies Policy, particularly in the table we have provided at the end.